个人信贷评分系统设计与分析

摘 要

个人消费信贷业务经过近两年的快速发展,市场初具规模,改变手工操作模式和借助科技手段实现贷款风险控制的要求相当迫切。为此,个银部于2001年6月正式开始进行个人消费信贷系统的可行性研究工作, 基本完成了项目的可行性研究论证和业务需求报告。

由于两个系统业务构架相似,业务需求互补,可采取相同的技术实现方式。为避免总行同时推出两套类似的系统,合理利用资源,2002年2月21日,总行成立了由研发部牵头,个银部、房地产部、信息技术部、会计部参加的“个人住房贷款系统与个人消费信贷系统整合评估工作组”,经比较分析认为: 个人住房贷款系统和个人消费信贷系统进行整合,整合是必要的,也是可行的。行领导指示尽快抓紧实施。

针对现行的我国商业银行在建立个人电子消费信贷风险评价指标体系过程中存在的对内、对外多套指标体系及手工计算指标,这些都是难以适应监管指标变化等的一些问题。本论文设计了一个信贷评分体系,并实现了信贷风险管理。本文就个人信贷评分系统进行设计分析,系统实现按最新核算制度的规定,实现个人信贷系统的各项业务核算功能。能够同现有的城市综合业务网实时交易,可以自动进行委托扣款。实现个人贷款审批电子化,贷款流程控制参数化。按照指标进行客户、风险和合作方等数据分析功能。实现客户评价功能、达到客户信息共享,提高全行信息利用水平,并为人行信贷登记系统提供信息。首先探讨了电子消费信贷信用风险评估信息系统的发展,对其在国内外的发展现状做了详细的阐述,比较了传统的信用风险评估方法与现行信用风险评估方法的区别和优缺点。其次,针对商业银行消费信贷业务情况,设计了个人信用贷款客户信用评估标准的评估指标。主要由个人基本状况、衡量还款能力且对贷款起着抵押担保作用的价值体系、衡量还款意愿的信誉体系和与本行关系四大部分组成,这些构成一级指标体系。在一级指标体系之下,又精心选择了年龄、受教育程度、月收入、月还款额与月收入比率、贷款历史信用记录、个人司法记录等共14个具有代表性的指标,组成个人信用评分的二级指标体系。之后,我们结合某商业银行信贷评估运行现状,建立了个人信贷风险管理系统。包括客户基本信息管理、指标管理、客户评分以及后台管理四个模块,详细分析了信贷风险管理系统的基本思想与目的,最终得出风险管理系统的系统模型。最后,我们简单以一个用户为例,通过用户登录、用户信息修改、用户评分,最终得出用户信用得分表。

关键词:信贷;信贷指标;信用风险;评估系统;

Design and analysis of personal credit scoring system

Abstract

Personal consumption credit business after nearly two years of rapid development, the market has begun to take shape, change the manual mode of operation and the use of scientific and technological means to achieve the requirements of the loan risk control is very urgent. To this end, the Department of silver in June 2001 officially started the feasibility study of personal consumption credit system, the basic completion of the feasibility study of the project feasibility study and business requirements report.

As the two systems business architecture is similar, business needs complementary, the same technology can be adopted to achieve the same way. In order to avoid the head office also launched two sets of similar systems, rational use of resources, in February 21, 2002, the head office was set up by the R & D department, silver department, real estate department, the Department of information technology, the accounting department to participate in the "integration of individual housing loans and personal consumption credit system assessment working group", by comparative analysis that: the integration of the personal housing loan system and personal credit system, the integration is necessary and feasible. Line leadership instructions as soon as possible to seize the implementation.

Aiming at the establishment of personal consumer credit risk evaluation index system in the process of China's commercial bank's internal and external multi index system and index calculation, these are some problems difficult to adapt to the changes of the regulatory index. This paper designed a credit scoring system, and realized the credit risk management. In this paper, the personal credit scoring system for the design and analysis, system to achieve according to the latest accounting system, the realization of individual credit system of business accounting function. With the city integrated service network real-time transaction existing, can be automatically commissioned from. To achieve personal loan approval, the loan process control parameters. For customers, partners and other risks and the function of data analysis in accordance with the index. To achieve customer evaluation function, to achieve customer information sharing, improve the level of the whole line of information use, and to provide information for the bank credit registration system. First discusses the development of electronic consumer credit risk assessment information system, the current situation of its development at home and abroad in detail, compare the traditional credit risk assessment methods and the current credit risk assessment methods and the advantages and disadvantages. Secondly, according to the consumer credit business of commercial banks, the evaluation index of the credit evaluation standard of individual credit loan is designed. Mainly by the basic situation, measure the repayment ability of loan and play four parts of value system, mortgage repayment will measure the effect of credit system and the relationship with the bank, these constitute an indicator system. Under the level of index system, and carefully select the age, education level, monthly income, monthly payments and monthly income ratio, loan credit history records, personal judicial records a total of 14 representative indexes, two level index system of personal credit scoring. After that, we combined with the current situation of a commercial bank credit evaluation, the establishment of a personal credit risk management system. Includes customer basic information management, index management, customer evaluation and background management of four modules, a detailed analysis of the basic idea and purpose of credit risk management system, the system model finally concluded that the risk management system. Finally, we simply take a user as an example, through the user login, user information changes, user ratings, and finally come to the user credit scoring table.

Key words: credit; credit index; credit risk; evaluation system;

目 录

第一章 引言 9

1.1论文研究背景 9

1.2国内外相关工作现状 9

1.2.1国外相关工作现状 11

1.2.2国内相关工作现状 13

1.3本文主要研究内容 15

第二章 个人信贷评分系统综述 17

1.1 系统综述 17

1.2 系统目标 18

第三章 系统设计方案 20

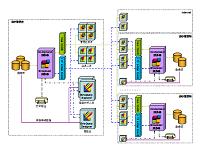

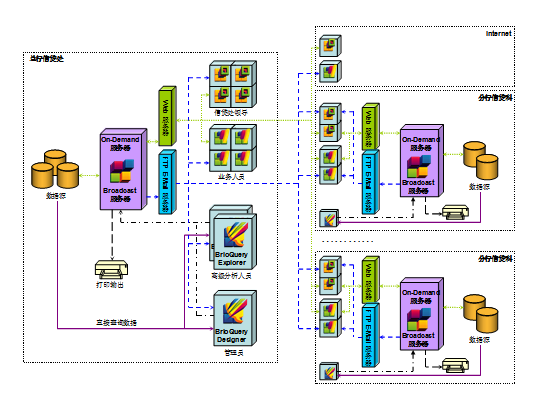

3.1信贷系统整体架构 20

3.2 系统体系结构 21

3.3应用体系结构 23

3.4 数据体系结构 24

第四章 系统建设方案 25

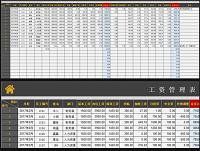

4.1 数据抽取 26

4.2 数据分析 26

4.3 信贷计划 27

第五章 系统软件说明 28

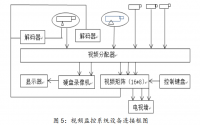

5.1 Brio Enterprise 简介 28

5.2 Brio Enterprise产品套件 30

5.2.1 基于Client/Server的用户工具 32

5.2.2 基于Web的用户工具 34

5.2.3 Brio Enterprise服务器解决方案 35

5.3 Brio Enterprise的功能特点 39

5.4 Brio Report简介 44

5.5 Brio.Report的优势 46

第六章 信用风险内部评级系统的设计 53

6.1系统总体设计 54

6.1.1 系统体系逻辑结构设计 54

6.1.2 系统功能结构设计 55

6.3系统数据库设计 56

6.3.1 概念结构模型设计 57

6.3.2 物理结构模型设计 58

6.4本章小结 60

第七章 信用风险内部评级系统的实现 60

7.1开发工具与运行环境 61

7.2系统功能模块的实现 61

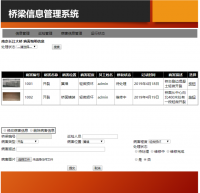

7.2.1客户管理功能实现 61

7.2.2财务分析功能实现 64

7.2.3债项管理功能实现 66

7.2.4评级管理功能实现 67

7.2.5风险应用功能实现 69

7.2.6系统管理功能的实现 71

7.3本章小结 72

结论 72

参考文献 74

参考文献

1. CHRISTIAN BAUER and GAVIN KING. Java Persistence with Hibernate. MANNING Greenwich

2. Kevin Loney,George Koch and the Experts at TUSC. Oracle9i:The Complete Reference. Oracle Press

3. bruce esker. thinking in java. Prentice hall prt

4. 刘斌编著. 精通Java Web整合开发. 北京:电子工业出版社,2007.11

5. 强锋科技,邱哲 王俊标 马斗编著. Struts Web设计与开发大全. 北京:清华大学出版社, 2006.2 6. 强锋科技,陈刚 编著. Eclipse从入门到精通. 北京:清华大学出版社,2005.6 7. 阎宏编. Java与设计模式. 电子工业出版社,2002.10

8.孙卫琴. JSP应用开发详解:基于MVC的Java Web设计与开发. 北京:电子工业出版社,2004.1 9.王小云, 杨玉顺, 李朝晖.ERP 企业管理案例教程.清华大学出版社, 2007

http://www.bysj1.com/ http://www.bysj1.com/html/5215.html http://www.bysj1.com