我国企业增值税的现状及改进—基于国源税务师事务所的调查数据

摘要: 增值税的发展在一定程度上体现了市场经济体质的成熟。这是纳税过程更加人性化的体现。这种成熟化可以从一个侧面反映出一个国家的经济发展程度或者是体现民众的纳税水平和程度。反应了税管部门的征税水平。在当今经济发展的过程中,我国企业的位置越来越重要,并且还在继续的发展壮大,我们需要充分提高经济管理水平。有利于使他保持更好的增长势头。 增值税作为一个非常重要的税种,带给企业的影响与其他的税种相比也是很大的。 并且通过在国源税务师事务工作的经历,笔者发现了在增值税方面所存在的漏洞。通过税务所的实习经历来分析制约我国增值税改革发展的因素,从而来分析怎样基于增值税的现状加以改进。总结出了一些发展过程中会出现的问题。并且提出改进的方案还有若干的建议。

关键词:增值税;企业;现状改进

Present situation and improvement of corporate tax in our countrl - based on the source of tax accountant firm survey data

Abstract:The development of value added tax reflects the maturity of the market economy in a certain extent. This is the embodiment of the tax process more humane. This maturity can reflect a country's economic development degree or reflect the people's tax level and degree from one side. Reflects the level of Taxation of the tax authorities. The author's point of view is tax planning for taxpayers in accordance with the provisions of the law within the allowed range, through investment financing or management, transaction organization and hundreds of corporate activities of arrange matters and events planning preparation. So you can make enterprises to minimize the tax revenue and profit maximization, so you can better realization of exemption from obligations to pay taxes or reduce tax obligation, sometimes also can realize deferred tax liabilities, to seek agile maximization, the tax optimization in efforts to achieve profits after tax cash flow maximization. In the process of economic development, the status of China's enterprises is becoming more and more important, and continue to grow and grow, we need to fully improve the level of economic management,. Is conducive to keep him to maintain a better growth momentum. Value added tax as a very important tax, to bring the burden of enterprises and other types of taxes is also great.We first the concept and the characteristics of value-added tax and selection are discussed in this paper, clarify the tax evasion and tax difference, the theoretical basis of tax and the implementation of the conditions were studied, also consider current value-added tax in our country present characteristics and principles, or is the motivation and misunderstanding of elaborate their point of view. Then it introduces the problems in the process of tax revenue in detail, especially the typical examples of tax administration to analyze the factors which restrict the development of China's value-added tax reform. Starting from the life of the specific case, so as to analyze how to strengthen the development of value-added tax. Summed up some of the problems that will arise in the course of development. And some suggestions are put forward to improve the scheme.

Key Words:value added tax enterprise Current situation and improvement

目 录

目录

一、引言 2

二、企业增值税概述 3

(一)增值税的概念 3

(二)增值税的纳税人 3

(三)增值税的特点 3

1.对经济活动有较强的适应性 3

2.有较好的收入弹性 4

三、增值税管理现状分析-国源税务师事务所 4

(一)企业财务人员对增值税理解不到位 4

(二)管理层对增值税认识不足 4

(三)对增值税改革发展的风险认识不足 5

(四)不能体现企业的最终税负 5

(五)易受使用增值税专用发票的限制 5

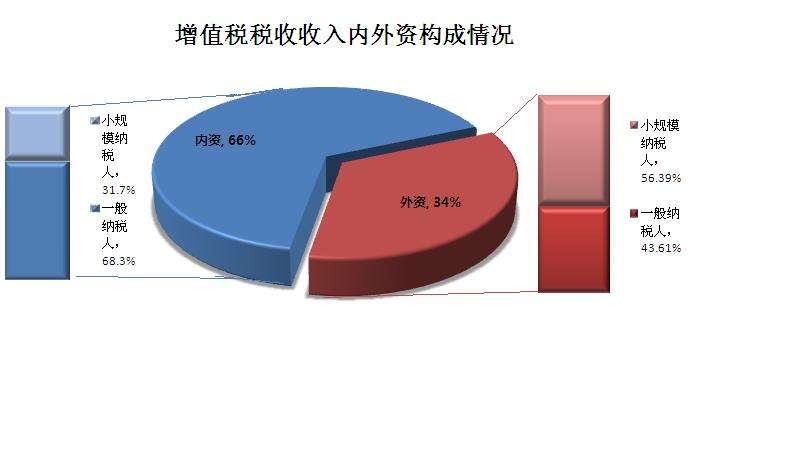

(六)国家增值税发展现状 6

四、加强增值税管理的对策 6

(一)解决对策 6

1、定期培训提高财务人员的素质 7

2、提高管理层对增值税征收的科学认识 7

3.研究税收政策,降低改革风险 7

4.构建全面增值税征收体系 7

五、总结 8

参考文献 8

参考文献

[1]陈晓光. 增值税有效税率差异与效率损失——兼议对“营改增”的启示[J]. 中国社会科学,2013.

[2]罗宏,陈丽霖. 增值税转型对企业融资约束的影响研究[J]. 会计研究,2012.

[3]程子建. 增值税扩围改革的价格影响与福利效应[J]. 财经研究,2011.

[4]陈烨,张欣,寇恩惠,刘明. 增值税转型对就业负面影响的CGE模拟分析[J]. 经济研究,2010.

[5]平新乔,梁爽,郝朝艳,张海洋,毛亮. 增值税与营业税的福利效应研究[J]. 经济研究,2009.

[6]刘天永. 金融业营业税改征增值税计税方法问题的研析[J]. 税务研究,2013.

[7]肖绪湖,汪应平. 关于增值税扩围征收的理性思考[J]. 财贸经济,2011.

[8]施文泼,贾康. 增值税“扩围”改革与中央和地方财政体制调整[J]. 财贸经济,2010.

[9]王素荣,蒋高乐. 增值税转型对上市公司财务影响程度研究[J]. 会计研究,2010.

[10]樊勇. 增值税抵扣制度对行业增值税税负影响的实证研究[J]. 财贸经济,2012.

http://www.bysj1.com/cat.asp?id=23

http://www.bysj1.com/cat.asp?id=25