论信用条件对江苏思科生产经营的影响

摘要:近几年国内实体经济发展较前些年略缓,然而各类企业依旧五光十色,货物产品供过于求,买方市场也随之而成。各企业之间竞争的势头依旧如日中天,各大企业为了升高产物的销售量,夺取更大的利益,提升本企业在市场竞争的能力,率先占领市场先机,大多数企业都会采用赊销的经营方法,给合作方提供信用折扣。企业为了扩大本身生产规模,从而夺取更多的订单量,通常会采取商业信用促销作为吸睛点来吸引买方企业。通常情况下,企业都会依据本行业的往例给予信用条件,虽然企业的信用条件依据一定的客观因素,也考虑了本企业自身资金实力,贯彻提高效益和加强竞争力原则而确定,但是也极易给企业造成大量的应收账款。采取信用条件极易产生的应收账款对于企业的长期经营也是有一定的风险性的,举例而言,它可能会增加企业的现金流出、占用企业的部分流动资金、长期收不回只能做坏账处理、还会过分夸大企业的利润。企业一旦出现不合理的管理,还很容易造成企业资金流就此中断,从而激发一大波的财务危机,甚至可能会兼并或是倒闭。因此,企业在给出信用条件时一定要审时度势,知己知彼。现如今许许多多的企业因为盲目制定信用条件,对应收账款分析的不全面,从而对应收账款的收回造成消极的影响。本文首先交代了信用条件的情况以及它对公司的正反两面影响,然后再就消极影响进行深度的剖析,最后抛出规避风险的对策。

关键词:信用条件;应收账款;影响;剖析;对策

On the influence of credit conditions on the production and management of JiangSuSiKe

Abstract:in recent years, Domestic entity relatively few slightly slow economic development. however, all of kinds enterprise still colours, goods exceeds the demand, thereby into a buyer's market. Momentum is still heyday, competition between companies, companies for the sake of increase product sales, in the market, to gain more interests and promote the enterprise competition ability, take the lead in occupying the market, most companies will sell on credit management methods, partners to provide credit discount.Enterprises for purpose of expand the scale of production itself, so as to capture more orders, usually take commercial credit promotion as suction eye point to attract the buyer of the enterprise. Under normal circumstances, enterprises will be based on the industry to give credit conditions, although the enterprise credit conditions based on certain objective factors, also consider the enterprise own capital strength, the implementation principles and to improve business efficiency and enhance competitiveness, but also easy to give rise to a good deal of accounts receivable to the enterprise.Take easy to produce the accounts receivable credit conditions for enterprise's long-term management also has some risk. for example, it may increase the enterprise's cash outflows, occupy part of corporate liquidity, long-term close not back can only make bad treatment, will exaggerate the profit of enterprise. Once appear unreasonable management, but also very easy to cause the enterprise cash flow on the interrupt, thus arouse a big wave of financial crisis, may even mergers or collapse.Therefore, the enterprise must assess the situation when credit conditions are given, the enemy and know yourself. Nowadays many enterprises because blindly adopt credit conditions, the analysis of the accounts receivable is not comprehensive, thus cause negative effect to the accounts receivable to recover. This article first narrates the credit conditions of circumstance and its affect on the pros and cons of the company, then to negatively influence carries on the deep analysis, finally throw out countermeasures to avoid risk.

Keywords: credit conditions, accounts receivable, influence, analysis, countermeasures

目 录

摘要、关词 1

一、绪论 2

(一)信用条件的含义 2

(二)信用条件的意义 2

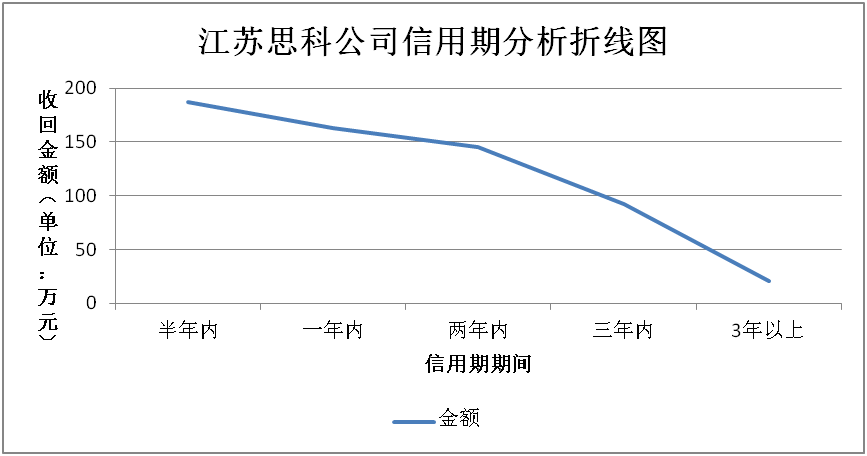

二、江苏思科电缆有限公司信用条件的情况 2

(一)江苏思科电缆有限公司的概况 2

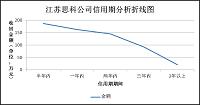

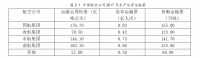

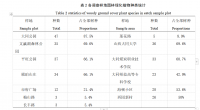

(二)江苏思科电缆有限公司信用条件的情况 3

三、信用条件对江苏思科电缆有限公司的影响 5

(一)信用条件对江苏思科电缆有限公司的积极影响 5

(二)信用条件对江苏思科电缆有限公司的消极影响 6

四、信用条件对江苏思科电缆有限公司消极影响的原因 9

(一)客户信息管理存在问题 9

(二)信用条件的风险 9

五、合理规避江苏思科电缆有限公司信用条件的风险的对策 10

(一)引用信用管理 10

(二)加强公司部门的沟通与运作 12

六、结论 13

参考文献 14

参考文献

[1] 姜海峰.传统销售业务流程的缺陷控制[J].当代经济,2007,04:105-106.

[2] 邹力行.信用条件变化与政策完善[J].东北财经大学学报,2016,02:3-4

[3] 张青.信用与企业信用制度[J].湖北财经高等专科学校学报,2004,01:20-21

[4] 董鸿乐,孙稳.中小企业赊销必须权衡信用条件[N].国际商报,2008-11-18

[5] 周晓丽.浅析企业应收账款的信用管理[C].2016年第一届今日财富论坛:中国会议,2016-03-15

[6] 雪纺连衣裙.传统销售业务流程的缺陷控制,http://blog.sina.bysj1.com.cn/u/5700560491

[7] 李娟,张红,陈杨.销售人员的薪酬激励中存在的问题与对策研究[J].现代经济信息,2011:72-74

http://www.bysj1.com/html/6464.html

http://www.bysj1.com/html/6462.html